Spend for Your Future: Understanding the EB-5 Visa and Visa Process

The EB-5 Visa program provides an engaging method for foreign financiers looking for united state permanent residency with calculated investments that promote work creation - Targeted Employment Area TEA. With a minimum investment limit of $800,000, this program not only promotes the financier's immigration procedure however also contributes to the broader financial landscape. Maneuvering with the intricacies of eligibility needs, financial investment alternatives, and the application timeline can be complex. Comprehending these aspects is necessary for making informed choices that might significantly affect your future, yet lots of potential applicants continue to be unaware of the nuances entailed

Review of the EB-5 Visa

The EB-5 Visa program uses an one-of-a-kind path for foreign financiers looking for permanent residency in the USA. Developed under the Immigration Act of 1990, this program aims to boost the united state economy through resources financial investment and job creation. Financiers who certify can get a visa for themselves and their immediate family participants by investing a minimum of $1 million in a brand-new business or $500,000 in a targeted employment area, which is specified as a rural area or one with high unemployment

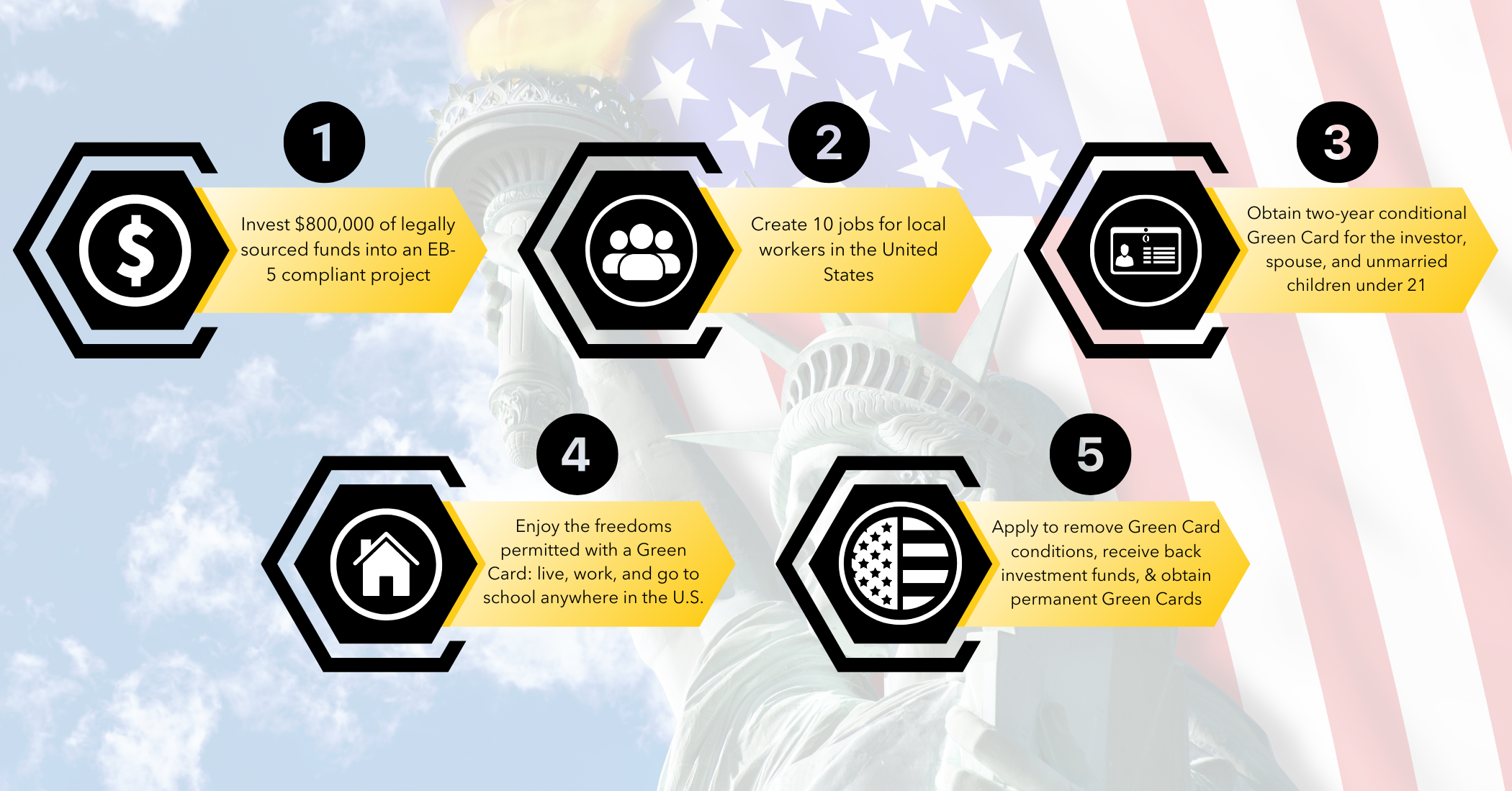

The EB-5 Visa not just assists in access to long-term residency but also enables capitalists to participate in a vivid market. By maintaining or producing at the very least 10 permanent tasks for U.S. employees, the financier can satisfy among the important needs of the program (Targeted Employment Area TEA). The investment can be made straight in a business or with a designated Regional Center, which handles the financial investment procedure and job development in behalf of the investor

Eligibility Needs

To qualify for the EB-5 Visa, financiers should meet particular credentials and adhere to prescribed financial investment amounts. These demands are developed to assure that candidates add significantly to the united state economy while likewise boosting task development. Comprehending these qualification criteria is essential for prospective capitalists looking for irreversible residency through the EB-5 program

Capitalist Qualifications

Investor certifications for the EB-5 visa program are essential in figuring out eligibility for involvement in this pathway to long-term residency in the United States. To certify, a capitalist needs to be a foreign nationwide who wants to buy a brand-new company that produces tasks for U.S. employees.

The investor should demonstrate that they have the requisite capital, which can be sourced from legal methods. In addition, the capitalist's funds need to go to risk, indicating they can not be assured a return on their financial investment. This standard highlights the requirement for dedication to the venture.

Furthermore, the capitalist must be actively included in the management of business or have a policy-making role, assuring that they are adding to the success of the business. Significantly, the investor has to also fulfill the minimum age need of 21 years.

Lastly, it is crucial for capitalists to verify that their investment aligns with the EB-5 program's geographic and economic standards, especially if buying a targeted employment area (TEA), which may provide particular benefits. Understanding these credentials is critical to maneuvering the EB-5 visa process effectively.

Financial Investment Amounts Required

Eligibility for the EB-5 visa program hinges substantially on the investment amounts called for, which are readied to ensure that foreign financiers contribute meaningfully to the U.S. economic climate. Since the most recent guidelines, the minimum investment required is $1 million. This amount is reduced to $800,000 if the investment is made in a targeted work location (TEA), which is normally a rural area or one with high unemployment rates.

These financial investment amounts are important as they are created to promote job development and financial growth within the United States. Each EB-5 financier is needed to demonstrate that their financial investment will maintain or produce a minimum of 10 permanent tasks for united state employees within 2 years of the investor's admission to the nation.

In addition, it is vital for investors to carry out extensive due diligence when choosing a task, as the potential for work creation and the general stability of the investment directly influence the success of their application. Comprehending these economic demands is a fundamental action in guiding with the EB-5 visa procedure and protecting a pathway to long-term residency in the U.S.

Financial investment Options

When taking into consideration financial investment alternatives for the EB-5 program, it is necessary to recognize the various sorts of investments readily available. Capitalists must likewise analyze the connected threats, guaranteeing a knowledgeable choice that aligns with their economic objectives. This conversation will explore both the kinds of financial investments and efficient risk evaluation strategies.

Kinds of Investments

The landscape of EB-5 investments offers a selection of alternatives customized to satisfy the varied goals of possible capitalists. At its core, the EB-5 program permits individuals to spend in brand-new business that will produce or maintain at the very least 10 full time jobs for qualifying united state employees.

Alternatively, capitalists can choose direct financial investments in their own service endeavors. This path requires a more hands-on method and straight involvement in handling the venture, enabling higher control over the investment.

Furthermore, financiers can take into consideration typical financial investments in accepted projects that meet the EB-5 criteria. These can vary from manufacturing centers to hospitality advancements, each with prospective returns and unique offerings.

Inevitably, the choice of financial investment should straighten with the investor's economic goals, threat tolerance, and level of wanted involvement, allowing them to satisfy visa requirements while pursuing development possibilities in the united state economy.

Danger Assessment Approaches

Effective threat examination techniques are necessary for EB-5 financiers looking for to browse the intricacies of financial investment options. Assessing the practicality of an investment calls for a comprehensive understanding of both the economic landscape and the details task concerned. Financiers need to begin by conducting due diligence on the Regional Center or job enroller, inspecting their record, financial stability, and conformity with EB-5 guidelines.

It is vital to assess the market problems appropriate to the investment. Analyzing the local economic climate, sector fads, and competition can give insights into potential threats and returns. Capitalists must also consider the project's task development possibility, as this is a crucial requirement for EB-5 visa eligibility.

Diversity can mitigate dangers connected with private financial investments. By spreading out funding throughout several tasks or sectors, investors can reduce the effect of a single financial investment's underperformance. Lastly, engaging with experienced legal and financial consultants can aid navigate complicated guidelines and identify warnings that may not be promptly apparent.

The Regional Facility Program

Made to stimulate economic growth and task production in targeted locations, the Regional Center Program is a pivotal part of the EB-5 visa campaign. Established by the United State Citizenship and Immigration Solutions (USCIS), this program enables financiers to merge their resources right into marked Regional Centers, which are entities authorized to promote financial investment jobs that fulfill specific financial standards.

The key purpose of the program is to create or preserve at least ten full time work for united state employees per financier. Regional Centers typically concentrate on economically distressed locations, consequently boosting neighborhood economies while providing a pathway to long-term residency for foreign investors. By investing a minimum of $800,000 in a targeted work area (TEA) or $1,050,000 in a non-TEA, investors can add to varied jobs, consisting of realty growths, facilities enhancements, and other company ventures.

In addition, investments through Regional Centers frequently involve a reduced burden of direct work development requirements, as the job development can be indirect or induced. This flexibility makes the Regional Center Program an attractive choice for lots of foreign nationals looking for to acquire an U.S. visa through financial investment.

Application Process

Steering through the application procedure for an EB-5 visa entails a number of essential actions that prospective investors must comply with to guarantee conformity with U.S. immigration laws. The primary step is to identify a suitable EB-5 task, preferably via a marked regional facility, ensuring it fulfills the investment and task creation needs.

As soon as a task is selected, financiers must prepare the needed documentation, which includes proof of the source of funds, a detailed organization strategy, and lawful agreements related to the financial investment. This phase is crucial as it establishes the authenticity of the investment and its placement with EB-5 requirements.

Following paper preparation, capitalists need to complete Form I-526, the Immigrant Application by Alien Financier. This type calls for complete information regarding the investor and the financial investment's certifications. As soon as sent, the petition undergoes evaluation by united state Citizenship and Migration Provider (USCIS)

Upon approval of the I-526 petition, financiers can continue to request their conditional visa. This phase entails submitting additional types and going to a meeting, where the financier needs to show their intent to fulfill the investment requirements and create the requisite tasks. Each of these steps is necessary for an effective EB-5 visa.

Timeline and Handling

Steering the timeline and handling for the EB-5 visa can be complex, as numerous factors affect the period of each phase. Typically, the procedure starts with the submission of Type I-526, the Immigrant Petition by Alien Investor. This initial petition can take anywhere from 6 months to over 2 years for approval, relying on the service center's workload and the specifics of the investment task.

When the I-526 request is authorized, investors might request conditional irreversible residency with Type I-485, or if outside the united state, they might experience consular processing. This step can take an added six months to a year. Upon getting conditional residency, investors should fulfill the financial investment and work development demands within the two-year period.

Benefits of the EB-5 Visa

The EB-5 visa provides a pathway to irreversible residency for foreign investors, giving them with substantial advantages past simply migration (EB-5 Investment Amount). One of the main benefits is the chance for capitalists and their prompt member of the family to get U.S. environment-friendly cards, providing them the right to live, function, and research in the United States without restrictions

On top of that, the EB-5 program boosts work production and economic development in the united state, as it needs investors to create or preserve at the very least 10 permanent work for American employees. This not only benefits the economic situation however likewise enhances the capitalist's area standing.

Moreover, the EB-5 visa is unique because it does not need a particular business history or previous experience in the U.S. market, allowing a broader variety of people to take part. Capitalists can additionally take pleasure in a relatively expedited course to citizenship after keeping their irreversible residency for 5 years.

Frequently Asked Inquiries

Can I Include My Family Members in My EB-5 Application?

Yes, you can consist of instant household members-- such as your spouse and unmarried youngsters under 21-- in your EB-5 application. This addition allows them to take advantage of the immigrant investor program together with you.

What Happens if My Financial Investment Fails?

If your investment fails, you may not fulfill the EB-5 program demands, causing the potential loss of your visa qualification. It's vital to conduct thorough due diligence prior to investing to reduce risks successfully.

Exist Age Restrictions for EB-5 Investors?

There are no particular age limitations for EB-5 investors. Candidates must show that they fulfill the investment requirements and abide with guidelines, regardless of their age, making sure eligibility for the visa procedure.

Can I Request Citizenship After Acquiring the Visa?

Yes, after getting a visa, you might get U.S. citizenship with naturalization. Normally, you have to maintain long-term resident condition for a minimum of 5 years, demonstrating good moral character and satisfying various other demands.

Exists a Limitation on the Variety Of EB-5 Visas Issued Each Year?

Yes, there is an annual restriction on EB-5 visas. Presently, the program designates 10,000 visas each , with look what i found added arrangements for member of the family of financiers, which can affect total availability and processing times.

The EB-5 Visa program offers a compelling avenue for international investors seeking United state permanent residency via tactical financial investments that promote work development. To certify for the EB-5 Visa, financiers should fulfill particular qualifications and adhere to prescribed investment quantities - EB-5. It is essential for capitalists to confirm that their investment straightens with the EB-5 program's geographical and economic criteria, especially if investing in a targeted work area (TEA), which might provide particular advantages. Eligibility for the EB-5 visa program hinges dramatically on the investment quantities required, which are set to ensure that international capitalists contribute meaningfully to the U.S. economic climate. Complying with document preparation, financiers need to finish Form I-526, the Immigrant Request by Alien Capitalist